If you want to derive a healthy return from investing in residential property, be aware of who you are buying it for. You'll own it, but it will be someone else's home. Because we have a special 'personal' connection with property, it's not easy for many of us to be emotionally detached and completely objective when making property investment decisions.

If we understand this deep attachment, and are conscious of it when searching for properties, we'll be in a better position to choose wisely and optimise a financial return.

Shelter - Our Core Need

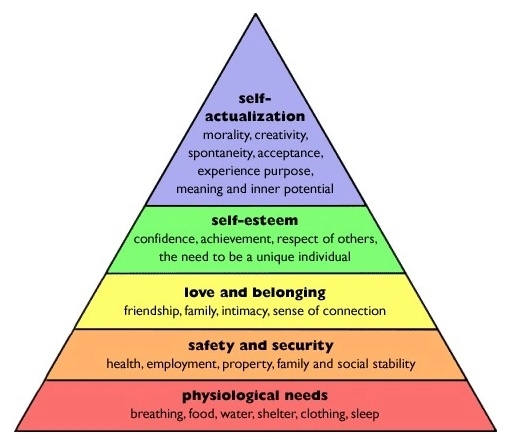

According to Maslow, we have a profound and inescapable connection to the importance of shelter (our home). It's primal and, surprisingly, assumes a greater priority than even health and safety. Our ‘cave’ needs to feel warm and comfortable in terms of location, disposition, function and decor.

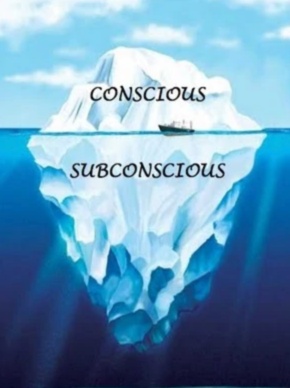

Our home environment preferences are so ingrained in our psyche, they subconsciously intervene and become a hinderance when searching for residential investment properties. We end up judging properties as if we were purchasing our own homes.

The confusion about purchasing an investment property with the same criteria used for purchasing our own home usually separates successful property investors from those who get into trouble.

Our minds Play Tricks

Injecting personal taste when searching for investment properties is at odds with the more important requirement to maximise investment return. If a property doesn't 'feel right', many potential investors give up and miss the opportunity of creating substantial wealth through property.

Alternatively, when people do find something they ' like', it can turn into an investment mistake. One of my associates purchased an investment property in Nambucca Heads in NSW because she really liked the area. I really like the area too and fish there regularly with family. However, as it is a holiday destination, she had trouble getting tenants in the off-season and had to sell at a loss.

Here's a test for you on investment choices.

Hypothetically, you have a choice between a beautifully renovated three storey terrace in the Sydney suburb of Paddington versus a three bedroom apartment on the Northern Beaches with water views. Would your approach be greatly different to choosing between purchasing BHP versus Commonwealth Bank shares on the Australian stock market?

It shouldn't be. They are both pure investment scenarios to make money.

When I consult with first time investors, their attachment to personal home-like preferences is revealed with comments like:

“Do you have anything in Sydney?" (for Sydney residents)

“I want a north-facing property.”

“The kitchen must have marble or granite benchtops.”

“It needs to be on a block at least 500sqm.”

“It must be walking distance to a train or bus station.”

The potential purchaser should examine whether these preferences arise from personal choices or rational investment analysis.

Watch for the Signals

The core objective of purchasing an investment property is to gain cash flow from rent and a future financial return from the appreciated value at sale. It must be remembered though that the return from either is entirely dependent on what others think and not you. You're purchasing a product for someone else to rent/buy. The more ‘other’ people you can appeal to, the greater the demand and the better the rental or future sale price.

When an agent advertises your property for rental, you want them lining up at the opening. When you sell down the track, you want a crowd at the auction. Apart from making money, what have your personal preferences about property got to do with it?

Let’s examine each of the above arbitrary quoted comments (signals) as it relates to an investment property purchase:

"Do you have anything in Sydney?" (for a Sydney resident)

)Why Sydney? It's our most expensive city and out of reach for many investment buyers anyway, particularly if they already have a home in there. Other capital cities currently have better short-term growth predictions with a much lower entry point. I’m not ruling out Sydney, but I’d suggest being open-minded about other areas. Don't let your preference of where you enjoy living limit your choices.

I often hear it's better to own an investment property near where you live because it's easier to drive past and check on it. This behaviour is either feeding an ego that needs bragging rights or it's nurturing fear the property might magically disappear through a wormhole (as happens in 'The Flash' movies I watch with my Son). Regardless of the reason, it’s not usually based on sound investment research.

There are plausible reasons to purchase nearby e.g. if you intend to personally renovate and sell quickly (ie. flip) as travel time can reduce costs. Even then, be careful to choose design schemes what will appeal generally to your market and not adopt what appeals to you.

Most of our lifelong bulk savings are in a managed Superannuation fund. It’s more than likely a reasonable portion of your Super will be invested in safe ‘Blue Chip’ shares e.g. Wesfarmers. Are you concerned where Wesfarmers' head office is located? What about the office décor and the wall colour in the tea rooms? I'm sure you'd be more concerned about the ‘return’ on your Super and not the physical appeal of each asset held in the fund. Why should an investment property be any different?

If you have done the research and are attracted to the predicted investment returns near your home location, then go for it. But if your starting out, keep an open mind on other areas as it can be a good strategy to diversify.

“I want a north-facing property.”

Do you think renters care if a property faces north? A lot of Aussies would prefer a south facing aspect. They may prefer the winter sun warming the backyard patio where they could enjoy a beer and a snag on the 'barbie'.

Others might prefer the sun along the side of the house illuminating and warming more of the living space.

Over the long term, do property values on one side of the street appreciate in value substantially more than the other side due to the sun aspect? Do they attract more rent? Nope.

You may like a property facing north (or south) for your home but don't assume your investment property renters or eventual buyer will feel the same.

Note. An exception of this is that, for religious reasons, some people require all properties they own to face a specific direction, irrespective of whether they are investment properties.

“The kitchen must have marble or granite benchtops.”

If you were to poll renters, you’d probably find they favour a functional kitchen rather than specific surfaces. In 15 years or more when you may want to sell (and make a killing), so you'd probably repaint, replace carpets and perhaps upgrade the kitchen to a more modern design anyway.

I understand engineered stone benchtops are all the rage. What will it be next year? Renters won't care. You'll be fine to just go with basic kitchen benchtops for now.

“It needs to be on a block at least 500sqm.”

Renters are busy people these days and not generally interested in spending their weekends mowing grass or labouring over garden maintenance. Rather than upkeeping pitch-length areas for backyard cricket, many would prefer their kids playing in safe common neighbourhood areas with friends. Future buyers will feel the same.

More land does not necessarily mean a more popular property. It will mean more cost for no additional rent.

Typically, the average capital growth as a percentage of the purchase price is not going to be more for larger blocks versus one that is say 350sqm in the same location. It just means the bigger blocks will be more expensive to begin with.

If there is a reasonable number of lower priced properties on smaller blocks in the area, they can create negative price pressure on the larger ones. It’s sometimes best to just go with the average land size for your chosen location.

When it comes to investing in property, size doesn't always count.

“It must be walking distance to a train station.”

Ok, this is controversial. I hear you. "What! How could you say a house within walking distance to a train station is not a good investment decision?". I'm not saying that. There are obvious benefits supporting proximity to transport which adds to the desirability of a property and warranting it as a good investment choice. My point is, this criteria is not mandatory and will limit your choices. You will also pay a higher price.

Suburban properties in our eastern seaboard capitals have enjoyed a healthy growth over the last 10 years irrespective of whether tenants can easily leg-it to the nearest train depot.

Good luck getting to a train station if you live in Sydney’s prestigious Northern Beaches. Even the sought after location, French’s Forest is a good 25 minute drive to the nearest station.

Renters and future buyers of your property will be looking for affordability and it’s unlikely to be next door to Sydney Rail stops.

I live within 2 km of a train line and the screeching brakes of the passing coal trains from Lithgow keep me awake. Train station neighbourhoods suffering from train noise, parking congestion and security issues are not attractive to everyone.

People won't mind a 15 to 20 minute drive to a station. Within our capital cities and major regional towns, the buses are generally a good fill in anyway. Don't limit your choices based on your personal biases.

Keep emotions in check

But there is only one you, and your selection will appeal to fewer people - and people are fickle. What is chic today is drab tomorrow.

Remember Maslow’s hierarchy of needs. You already have a shelter so no need to create another. The return on your investment property will be completely dependent on the market forces and the perception of others. Think of it as buying a gift for someone else to please them. You’ll never live in it and you don’t even have to like it or even see it.

Leave your personal preferences inside the front door of your home when you go looking. Investment properties are not about you. They are about your bank account. Don't lose sleep if your investment property doesn't have brushed nickel tapware in the laundry. Bob Basic and Joe Average properties can have the broadest appeal.

In the future when you sell, the basic economic principle will kick in. Higher demand for a given supply, will create higher prices.

Your future financial security

Property investment has helped create 90% of the world’s wealthiest people so it merits serious consideration. Interestingly, only about 7% of the population are investors - a low figure no doubt influenced by the contradictions within our psyche as discussed here.

Property investment will be your largest expense (apart from your home), so before you start, it's worthwhile seeking expert help to gain an understanding of how to:

- Create wealth from leverage

- Receive tax credits from depreciation

- Reduce debt and pay down your mortgage faster

When you eventually start looking for property, send your internal "home decorator" on holidays.

Now you are well on your way to creating a property portfolio like the wealthy.

If you need help to get started, we’d be keen to help you out (1300 39 19 00).

Financial security tomorrow is your peace of mind today. Start planning now and feel better already.

Comments

Hi jeff. Just checking the blog comment is working

Good article